Follow Us @

In the early morning of December 19, the 2022 Qatar World Cup ended with Messi lifting the Hercules Cup. In the arena, the pinnacle duel between the Pampas eagles and the Gallic roosters gathered the attention of the world; Outside the arena, the competition between Mengniu and its “old rival” Yili for World Cup traffic is also in full swing.

Here Mengniu threw $60 million to win the official sponsorship of the Qatar World Cup, signing favorites Messi and Mbappe; On the other hand, Yili signed Messi’s Argentina team, and “cast a wide net” with Germany, Spain, Portugal and stars Neymar, Benzema, David Beckham, Wu Lei to create a number of promotional labels.

Mengniu

In the World Cup final, coinciding with the match between Messi and Mbappe, Mengniu took advantage of the marketing “Messi Mbappe Mengniu loves more” to strongly appear on Weibo hot search, “prophecy emperor”, “Mengniu won numbness” and “completely not panicked” became hot words in the mouths of fans.

At the same time, the poster released by Yili responded that “no matter who you love, Yili only loves the Argentine team”, which also made many netizens like Yili’s “single-mindedness”.

In fact, for Mengniu and Yili, the head-to-head confrontation in the World Cup is just a microcosm of the “open and dark struggle” of this pair of “old wrongdoers” for 23 years. So who can be better in the competition between Mengniu and Yili outside the World Cup?

01 “Competitors cultivated by one”

Mengniu can be described as a competitor cultivated by Yili.

In 1983, 24-year-old Niu Gensheng entered the predecessor of Yili Group, “Hohhot Huimin Food Factory”, and with his excellent work ability, he rose all the way to the grassroots level and became the second in command of the company, and 10 years later became the vice president of the newly established Yili Group, mastering nearly 80% of Yili’s performance.

As the so-called “meritorious lord is a taboo for ministers”, Niu Gensheng and Yili leader Zheng Junhuai gradually became disgruntled, and finally left Yili, and founded Mengniu in 1999, preparing to “build another Yili”. Among Mengniu’s original entrepreneurial team, nearly 300 people were born under Yili’s old subordinates, and many of them were leaders of various departments of Yili.

Soon after its founding, Mengniu relied on 45 “touching porcelain” Yili billboards to catch fire, known in history as the “Mengniu billboard incident”, and the 23-year struggle between Mengniu and Yili also began.

At that time, Niu Gensheng, the founder of Mengniu, who believed in “building a market first, then building a factory”, concentrated resources to build a brand, contracting 45 roadside billboards in Hulunbuir, which read: Learn from Yili and create the second brand of Inner Mongolia Dairy. At that time, Yili, which had been listed on the A-share market for 3 years, was a well-deserved leading enterprise in the domestic dairy industry.

Even though more than 40 billboards were smashed that night, Niu Gensheng’s former Yili boss “halo” still made Mengniu famous, and orders were soft, and thus broke through Yili’s distribution channel blockade and became the second largest dairy company in Inner Mongolia.

Therefore, as the biggest beneficiary of the incident, there is no consensus on “who smashed the billboard”. Some people think that Yili made this strategy in order to strangle Mengniu in the cradle; Some people also think that Mengniu “directs and acts”, the purpose is to attract attention.

Immediately afterwards, the “marketing genius” Niu Gensheng planned several marketing events one after another, such as taking the lead in proposing that “Inner Mongolia is China’s dairy capital”, which was dreamily linked with its name meaning “Inner Mongolia’s cattle”, which not only established Mengniu’s status as a local representative enterprise, but also suppressed Yili; And through the “aerospace marketing” in 2003, “astronaut special milk” and 2005 “supergirl marketing” and “sweet and sour is me” quickly launched the brand, selling well throughout the country.

Under the leadership of Niu Gensheng, Mengniu’s sales soared from 43.65 million yuan in 1999 to 2.1 billion yuan in 2002, and its ranking among dairy enterprises in China rose from 1116th to 4th, and in 2004, it landed on the Hong Kong Stock Exchange and became the first dairy company listed in Hong Kong in Chinese mainland.

But Yili is not a vegetarian, and a battle is about to break out.

02 Catch-up and imitation

As today’s dairy company “duopoly”, Mengniu and Yili have not broken their wrists in marketing.

Mengniu sponsored “Super Girl”, and Yili sponsored CCTV variety shows; Mengniu became the official partner of China’s aerospace industry, and Yili won the exclusive sponsorship of dairy products for many Olympic Games.

And with the passage of time and the establishment of the “duopoly” status of the two, the marketing of Mengniu and Yili has opened the “double accommodation and double flight” model.

For example, the title confrontation of the popular variety show, Yili “An Muxi” sponsored “Run Brother”, and Mengniu “Trensu” sponsored “Longing for Life”; Mengniu “True Fruit” and “Chun Zhen” sponsored “Youth Has You” and “Creation Camp”, and Yili “Jindian” sponsored “I Am a Singer” and “Riding the Wind and Waves 3”.

In the marketing offensive of the two sides, Yili and Mengniu have almost become synonymous with the dairy market, occupying most of the shelf space of online and offline retailers.

However, in addition to the similarity of marketing methods, Mengniu and Yili’s products are also very similar, and even often make people confuse whether the milk drunk this morning is Mengniu or Yili?

In fact, since Mengniu imitated Yili’s “yogurt” in 2005 to launch a-for-tat “yogurt”, Yili began to pixel-level imitation of Mengniu’s new products.

For example, Yili launched the “Golden Code” in 2006 to benchmark Mengniu “Trensu”; In 2008, the “more grains” were launched to benchmark Mengniu “real fruits”; In 2012, the “Chang Light” benchmark Mengniu “Guanyi Milk” was launched; Launched in 2014, “Anmuxi” benchmarks Mengniu’s “Chunzhen”.

Mengniu, which led the industry in marketing means and product innovation, finally achieved a comprehensive catch-up with Yili in the 8th year of its establishment, surpassing Yili in revenue and net profit that year, achieving revenue of 21.318 billion yuan, becoming the first dairy enterprise in China with a revenue of more than 20 billion yuan, and sitting on the throne of “China’s dairy industry”.

It is worth noting that even though Mengniu and Yili are very similar in marketing and products, they are very different in terms of specific development strategies.

First of all, in the layout of milk sources, Yili adopts a diversified layout, builds its own factories and strengthens in-depth cooperation with the upstream industrial chain; Mengniu continues the model of “first do the market, then build the factory”, focusing on fast, focusing on mergers and acquisitions, such as Mengniu’s tender offer to acquire modern animal husbandry that masters high-quality milk sources, which may be related to the serious homogenization of the dairy industry at that time and Mengniu’s breakthrough.

Secondly, in the layout of downstream channels, Yili adopts a modern channel management system, and sales personnel assist dealers to develop market maintenance terminals, and adopt flat and refined management; Mengniu implements a large-scale business strategy, and after gradually increasing the scale, it has cultivated a group of strong dealers, which causes Mengniu to need more money to promote channel marketing, and the sales expense ratio has grown much faster than Yili.

On the whole, Yili’s development strategy focuses on refined management and achieving “organic growth” of performance through the company’s existing assets and business; Mengniu, on the other hand, relies more on mergers and acquisitions to quickly drive performance, and its management is more extensive.

The two models of “peacetime” have not yet shown much gap, and after the melamine incident “thunder”, Mengniu was gradually overtaken by Yili, and the gap between the two became wider and wider.

03 Niu Gensheng retreated, Mengniu stalled

In 2008, the melamine incident of Sanlu milk powder that caused a sensation in the country caused a shock in the entire dairy industry, and also brought about a crisis of trust in domestic dairy products in the whole society.

Mengniu and Yili, as the head dairy enterprises, were inevitably affected, but Mengniu’s previously established strategy of “making the market first and building factories later” led to Mengniu’s lack of layout in the upstream raw milk market, and consumers’ doubts and the division of the domestic market by foreign-funded dairy enterprises made Mengniu lose 950 million yuan that year, and even faced the crisis of being acquired by foreign-funded institutions.

Niu Gensheng, who was struggling to move, wrote a 10,000-character long letter “The Crime of China’s Dairy Industry and Treatment”, bluntly saying that Mengniu had reached the point of life and death, and asked Liu Chuanzhi, Yu Minhong, Ma Yun and others for help. In July 2009, COFCO and HOPU Investment jointly formed a new company (70% owned by COFCO) to acquire Mengniu, becoming Mengniu’s largest shareholder.

In August of that year, as the crisis gradually dissipated, Niu Gensheng resigned as chairman of Mengniu and was replaced by the president of COFCO. Until his resignation as a non-executive director and a member of the Strategy and Development Committee of the Company in November 2021, Niu Gensheng bid farewell to Mengniu once and for all.

Niu Gensheng once proposed a spaceship law, “Mengniu either grows in high speed or destroys at high speed.” If you can’t reach the surround speed, then you can only fall. ”

However, with the retirement of Niu Gensheng, Mengniu gradually lost its “surround speed”, not only missed opportunities in terms of products, but also let the “explosive manufacturing machine” Yili come first, and surpassed Mengniu in 2015, even stronger than Yili’s marketing field, Mengniu also lost points and overturned continuously.

For example, in the endorsement of traffic stars, Xiao Zhan’s “227 incident” since 2020, Luo Zhixiang’s private life scandal and Li Yifeng’s detention of “prostitution” have all hit Mengniu’s brand image and product sales; In 2021, as a sponsor of “Youth with You 3”, the “milk pouring incident” made CCTV news criticize the “top wind crime”, which eventually led to the decline in Mengniu’s stock price, and the market value shrank by nearly 10 billion yuan.

In addition, after COFCO took over Mengniu, Mengniu’s core management was unstable, several changes of coach and chairman, and repeated jumps between the category-centered division system and the functional division system based on industrial chain links, all seriously affected organizational efficiency and performance stability.

In terms of corporate development strategy, after professional manager Lu Minfang took office in 2016, he still continued the extended mergers and acquisitions that Niu Gensheng and COFCO were accustomed to. For example, increasing its holdings in Modern Dairy and acquiring the equity of Shengmu Hi-Tech to control milk sources; Spent 7.111 billion yuan to acquire Australian dairy company Bellamy, forming a milk powder portfolio with Yashili; acquired Ai Xue, a Southeast Asian ice cream brand founded by Niu Gensheng, to accelerate overseas market expansion; and spent 4.1 billion yuan to continuously increase its stake in cheese leader Miokolanduo.

But frequent acquisitions do not necessarily lead to an increase in profits, but rather drag down overall performance due to business “indigestion”. For example, Yashili’s performance fell off a cliff after being acquired in 2013, and it lost 320 million yuan in 2016, once becoming Mengniu’s “drag oil bottle”.

And with the “solo flight” of Junlebao, the “pillar” of Mengniu’s milk powder business in 2019, Mengniu’s “200 billion plan” – by 2020, the company’s sales and market value will both exceed 100 billion yuan – followed by “aborted”.

In fact, under the circumstance that Mengniu and Yili’s liquid milk product revenue accounts for a very high proportion and the revenue gap is not large, the milk powder business is a key to whether Mengniu can achieve a performance reversal. In 2021, the revenue of 4.9 billion yuan of Meng’s milk powder business was much lower than Yili’s 16.2 billion yuan in the same period, accounting for only 5.6% of the total revenue.

Mengniu’s high-hopes cheese business With the increase of competitors, the market competition has gradually become intense, the “old rival” Yili even bluntly said that “its goal is to become the first brand of cheese”, in the first half of this year, the market share of Yili cheese business increased by 4% year-on-year, and the cheese business revenue in the first three quarters of this year increased by 30% year-on-year.

With the strong entry of Yili and Capital, it is still unknown how long Mengniu’s first-mover advantage of “grabbing” cheese can be maintained, not to mention the significant slowdown in the growth rate of Miaokolanduo’s cheese business. In the first three quarters of this year, Miaokolanduo’s cheese revenue was 2.959 billion yuan, a year-on-year increase of 29.66%, while the business growth rate in the first three quarters of 2021 was 69.91%.

After the “double hundred billion” plan failed, Lu Minfang shouted the goal of “creating a new Mengniu in 5 years” at the 2020 Mengniu performance meeting, which is simply understood to strive to double the sales revenue and profit of Mengniu in 5 years, double the market value, and realize Mengniu’s digital and intelligent transformation.

However, at the same time, Mengniu’s total R&D investment from 2019 to 2021 was 869 million yuan, and the advertising and publicity expenses in the same period were 22.511 billion yuan, and the R&D investment was even less than a fraction of the publicity expenses.

Perhaps, compared with recreating a new Mengniu on a large scale, Mengniu has to think more about whether it can break through the cocoon and rebirth in core strengths such as products, channels, and research and development.

Reference source:

1. Exploring Finance: How can Mengniu of “high gambling” marketing save the slowing performance?

2. Niu Dao Finance: Mengniu “rushed”: 800 million to make another move, Lu Minfang accelerated mergers and acquisitions

3. Blue Whale Finance: Niu Gensheng withdrew from Mengniu, and COFCO strengthened its control

4. Hong Kong stock decoding: Mengniu, whose net profit is less than half of Yili, can it surpass it in the next ten years?

5. New observation of barn national goods: “comrades-in-arms” have turned into enemies, fighting openly and secretly for 22 years, and Mengniu Yili has been chaotic at the beginning and end

SHARE TO EARN PASSIVE INCOME:

Join our Audience reward campaign and make money reading articles, shares, likes and comment >> Join reward Program

FIRST TIME REACTIONS:

Be the first to leave us a comment, down the comment section. click allow to follow this topic and get firsthand daily updates.

JOIN US ON OUR SOCIAL MEDIA: << FACEBOOK >> | << WHATSAPP >> | << TELEGRAM >> | << TWITTER >

Mengniu

-

News2 months ago

News2 months agoHarry decides to appeal after loss of police protection in the UK

-

Good News TV series2 months ago

Good News TV series2 months agoJustin Bieber and Hailey go to church using a powerful car

-

Good News TV series2 months ago

Good News TV series2 months agoPreta Gil is the new presenter of TVZ on Multishow

-

Good News TV series2 months ago

Good News TV series2 months agoFuzuê: Pascoal is sentenced to more than 70 years in prison

-

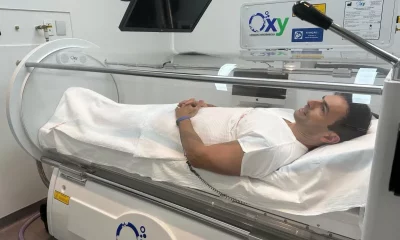

Health and Fitness2 months ago

Health and Fitness2 months agoHyperbaric Oxygenation accelerates recovery from knee injuries, according to USP study

-

News2 months ago

News2 months agoViradouro wins the Rio de Janeiro Carnival title in 2024 now news

-

Culture2 months ago

Culture2 months agothe Sub4 Turismo package that we recommend and we go (on the 42 km)

-

Good News TV series2 months ago

Good News TV series2 months agoCris discovers Isis's pregnancy. And now?