5 mistakes you shouldn't make when choosing the best car insurance

Follow Us @

5 mistakes you shouldn't make when choosing the best car insurance

-Receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more! Enjoy your stay!!

Take note of some mistakes you shouldn't make when choosing the best car insurance and make a safe and headache-free purchase!

Buying a car or a motorcycle is always a huge achievement, isn't it? Seeing that all your work has been rewarded with a material asset of this size is very gratifying.

Especially if it's a car launch, that is, the vehicle of your dreams. Of course, to be able to buy a car, you need a lot of discipline to save your money and a lot of planning too. With that, we can say that it is a gem.

Now imagine having just bought your car and ending up losing it? It would be bad, wouldn't it? Therefore, it is very important to be able to count on car insurance.

There are several points that must be taken into consideration to find the best car insurance for you. Therefore, we have brought some necessary and relevant information to help you in this search. Check it out below!

Image: Getty Images

5 mistakes you can't make when choosing the best car insurance

Here are some mistakes you need to avoid to finally choose the best car insurance for your current situation.

1. Failing to do research on brokers

Researching the best insurance company is very important to avoid some common problems with your car or motorcycle.

Before even closing with a specific brokerage, research the competitors in your region. This way, you will be aware of issues such as price, coverage, company reputation and the best advantages offered.

Another point that characterizes the best car insurance is customer service, after all, as soon as you need to contact the broker, you will be going through a difficult situation, and they need to know how to help you.

2. Stop researching the value of the insurance

Generally, the value of insurance is paid in monthly installments. However, it is important to remember that, in most cases, this is not the only amount you will need to pay.

This is because, when you need to contact the insurance company, there is probably a fee that you will have to pay in addition to the monthly deductible.

This is precisely why you need to research and research the values of the deductibles and what they actually cover during an accident, crash or theft of your vehicle.

3. Failing to research insurance coverage

To consider good car insurance, you need to know exactly what the insurance covers. In the contract, all situations that the insurance covers must be clearly described to the contractor.

Therefore, research what services and coverage are available for the different situations you may face with your car.

One of the best advantages of good car insurance is offering a spare car when yours needs to be taken off the road. But, if you don't need this service, for example, you don't need to pay extra for it, as you won't use it.

4. Failing to define the main driver of the car

This is one of the common mistakes when taking out car insurance. Understanding shared driving of a vehicle, in the case of couples who share the same car, for example, is very important.

Informing the broker who the main driver is is essential to define some car insurance authorizations. In cases like these, the main driver is considered to be a minor and is primarily responsible for the vehicle.

5. Failing to update information

We often fail to take out better car insurance due to the lack of information we provide.

It is very important that all changes regarding your profile are passed on to the broker so that there are updates to your registration.

Even the simplest to the most complete changes must be reported to car insurance. This is because these changes may directly imply the contracting of the services described in the contract.

It is important that there are no discrepancies in the information, so be careful to submit all the necessary documentation to your broker to take out better car insurance and avoid any type of future problem.

Choosing the best car insurance can be a little difficult as it requires patience and dedication to select the best benefits and services that company has to offer.

However, it is worth taking into consideration these points mentioned above and be sure to research the company's reputation. Look for clients or former clients and see if it's really worth it.

This way, you guarantee that you are getting the best car insurance.

5 mistakes you shouldn't make when choosing the best car insurance

Follow AFRILATEST on Google News and receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more!

5 mistakes you shouldn't make when choosing the best car insurance

SHARE POST AND EARN REWARDS:

Join our Audience reward campaign and make money reading articles, shares, likes and comment >> Join reward Program

FIRST TIME REACTIONS:

Be the first to leave us a comment, down the comment section. click allow to follow this topic and get firsthand daily updates on Insurance.

JOIN US ON OUR SOCIAL MEDIA: << FACEBOOK >> | << WHATSAPP >> | << TELEGRAM >> | << TWITTER >

5 mistakes you shouldn't make when choosing the best car insurance

#mistakes #shouldn39t #choosing #car #insurance

-

News3 months ago

Harry decides to appeal after loss of police protection in the UK

-

Good News TV series3 months ago

Preta Gil is the new presenter of TVZ on Multishow

-

Good News TV series3 months ago

Justin Bieber and Hailey go to church using a powerful car

-

Good News TV series3 months ago

Fuzuê: Pascoal is sentenced to more than 70 years in prison

-

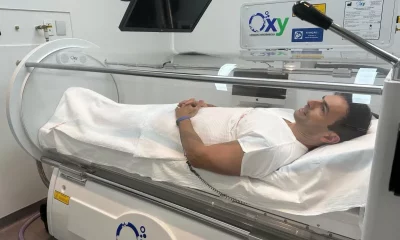

Health and Fitness3 months ago

Hyperbaric Oxygenation accelerates recovery from knee injuries, according to USP study

-

Trending Game3 months ago

Season 4 of Mortal Kombat 1 launches today with new trailer

-

Trending Game3 months ago

5 Pokémon-inspired games worth checking out now on Steam

-

Good News TV series2 months ago

The Childhood of Romeo and Juliet: Cast reunites in the final stretch