Be careful when naming the main driver on your car insurance

Follow Us @

Be careful when naming the main driver on your car insurance

-Receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more! Enjoy your stay!!

Follow this article and understand the problems you may have when naming the wrong main driver on car insurance. This is one of the most important pieces of information when purchasing insurance and directly affects the value of the service.

In search of savings, those who take out car insurance often try to “mask” the insurer’s reality.

This happens, for example, when the user indicates the main driver of the car insurance that is different from reality.

Get a quote for your car insurance now, simple, fast, online and 100% safe!

Although it may seem beneficial at the time, this type of irregularity has an impact on the payment of compensation.

A good example of this situation is when we find parents who name themselves as pmain driver when, in reality, those who spend most of their time behind the wheel are their children.

Generally, this measure gives a certain discount on insurance, as the insurer considers older individuals to be more experienced in driving.

Therefore, they would be less subject to claims, and thus can count on cheaper insurance.

Follow this article and understand how careful you should be when naming the main driver of your car insurance and what the consequences are if you do it 'wrong'.

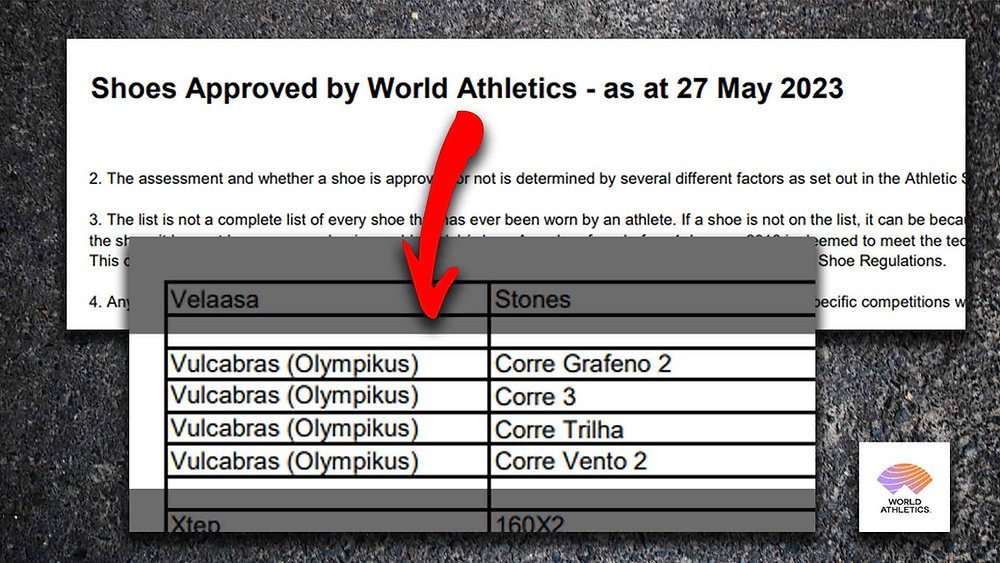

Image: Getty

Who is the main driver in car insurance

When car insurance is taken out, the consumer needs to fill out a risk assessment form, indicating who the main driver is.

Other data, such as the vehicle's traffic location and where it is kept parked on a daily basis, are also requested.

Based on this information, the risks of loss are defined by the insurer.

This means that the driver's profile, such as the individual's age, marital status, profession, driving history and others, will be evaluated.

And, the greater a driver's risk of accidents, the higher the cost of the protection premium.

As well as the car model, year of manufacture, safety equipment it has and other items and coverage to be contracted.

All this information together will make defining the value of car insurance possible.

Do you want to quote the best insurance for your car, we have the solution!

The main driver is always the person who drives the car 85% of the time it runs or more.

If we are talking about a car that belongs to the family and is used by more than two people, then the one who spends the most time with it should be named the main driver.

The other drivers in this case must be included in the policy as additional drivers.

Therefore, if a driver other than the main driver is involved in an accident, insurance coverage will be guaranteed.

Why appoint additional drivers?

When a main driver of a vehicle is named on the insurance, it does not mean that he will be the only one who can drive the car.

In fact, there is the possibility of appointing secondary drivers, those who spend less time behind the wheel, but who will also be subject to driving accidents.

It is quite common for insurers to charge an extra amount for each additional driver named.

However, this is a necessary expense, as only then will the user be sure of receiving compensation.

This is common, but it is important to see if Allianz, MAPFRE, Sompo Insurance, among others, follow this rule.

How does car insurance coverage for additional drivers work?

As mentioned, it is possible to add occasional drivers to your policy, some insurers only offer this possibility to drivers who live with the main driver and/or insured or are related to them.

In this first situation, it will be common for the insured to find a question in the car insurance risk analysis area regarding the existence of people between 17 and 24 years old or 18 and 25 years old who live with him.

Other companies offer the possibility of extending the coverage contracted to any other driver.

In this case, you will find, next to the risk analysis part, in the policy a question that says “do you want to extend coverage to drivers between 18 and 25 years old?”.

If you wish to include these people in the policy coverage, you must answer these questions positively.

It is worth mentioning that additional drivers are those who occasionally drive the vehicle, totaling a maximum of two days a week.

Furthermore, insurers usually only ask about drivers aged 18 to 25, as this age group is most prone to accidents and accidents.

Generally speaking, occasional drivers aged 26 or over are automatically included in policies.

What happens if a different driver is named on the car insurance?

It is extremely common to find policyholders who lie on their insurance company risk forms.

Generally, this happens because there is an intention to save on the final value of the policy premium.

Through “little lies” or omissions, they constantly get lower prices than expected.

As in the example already mentioned, in which parents generally put the insurance in their names, as they know that the premium value will be lower.

This is even if the children are the main drivers.

After all, the younger the driver, the less experience he has behind the wheel, and the greater the chances of being involved in an accident.

In situations of this type, where the incorrect profile is reported, the insurance company may deny compensation.

This applies to cases in which the parking location, marital status of drivers, traffic location or user address are omitted, and more.

All this because, if there is an accident, the insurance company will certainly investigate what happened in order to pay the compensation.

And, if during this investigation it finds that the information provided when purchasing car insurance is not in accordance with reality, the insured will have serious problems.

The least of the problems in this case is that, if the company proves that false information was provided on the form, intentionally, for the benefit of the insured, it may, supported by law, refuse to compensate for the damages caused by the accident.

In other words, the least of the problems is losing the right to contracted coverage.

In addition to these problems, insurance companies can cancel the insured's policy, without any refund of amounts already paid, and even sue the insured.

After all, by providing false information, the consumer commits fraud.

This is the reason for the denial of compensation.

If desired, the insurance company may sue the user for irregularities.

Therefore, when taking out car insurance, fill out the form carefully, providing all the information in a realistic manner.

If you notice inconsistencies after signing the contract, you can contact the company and get an insurance endorsement.

The endorsement must also be made if the data changes, such as after changing the insured's home address.

Should I include a sporadic driver in my car insurance?

It is important to understand a sporadic driver as a driver of your vehicle who almost, or never, drives it. But, if you have someone who is at risk of driving your car, you won't need to mention it on your insurance.

After all, the driver hardly drives the vehicle and, if he eventually takes the car and on one of these occasions suffers an accident, the insurance company will cover the loss. But remember, this only happens in the case of a driving exception.

If in doubt, we recommend speaking to your insurance broker or directly to Sompo Seguros, MAPFRE, Youse Seguros, Allianz or accessing the Porto Seguro or your insurer's customer portal.

What is an auto insurance endorsement?

The endorsement is nothing more than a document, created by the insurer, based on information provided by the insured, about some detail within the conditions alleged in the policy at the time of contracting, which was changed within its validity period.

It serves to validate any changes that occur with the vehicle, the driver's habits or even the main driver himself or the inclusion of other additional drivers in the car insurance policy.

For example, you became a monthly payer at a closed parking lot close to your work and no longer park your car on the street; your son got his license and will start driving your car; you have moved, or been transferred to another address at work, all of these situations generate an endorsement.

And don't worry, making an endorsement is very simple, just contact your insurance broker or directly with the insurance company and inform them of the need to make an endorsement.

The professional who assists you will provide you with all the information necessary to carry out the endorsement and in a short time it will be linked to your policy.

It is also important that you know that this change in the contractual conditions of the insurance policy will generate a change in the value of the premium.

This is because all information that generates endorsement is responsible for the pricing of car insurance.

Therefore, if you add your newly qualified 18-year-old child, the value of your premium could increase considerably.

However, if the endorsement is to communicate the existence of a closed parking lot near your work, the value could drop significantly.

Auto insurance deductible and coverage

With the precautions mentioned so far, you will be able to drive peacefully through the streets.

After all, you will know that, if something happens, you can count on the insurance company’s support.

Both for partial coverage of the loss and, if applicable, for receiving full compensation.

A partial vehicle loss occurs when the damage amounts to less than 75% of the car's purchase price.

In this situation, the insured will receive a portion of the amount needed to pay for repairs.

The other part of the payment for these repairs, generally the smallest part, will be borne by the insured, this payment is called a deductible by insurers.

The total loss of the car occurs when the damage is equal to or greater than 75% of the car's value.

Just like when the vehicle is stolen or stolen, and not recovered by the police.

In these scenarios, there is no deductible, and the user receives full compensation for the purchase of a new vehicle.

When purchasing insurance, remember to also consider the types of protection coverage.

It is important to talk to your broker and evaluate the most interesting options for your vehicle.

To find out the cost of your protection according to the main driver in car insurance, you can request several quotes from insurance companies.

Then, evaluate the best option for your vehicle among the plans offered by Youse Seguros, Sompo Insurance, among others. Don't lie or omit information!

It is better to pay a more expensive premium and stay safe, than to save on hiring and not receive compensation in the event of an accident.

If you have any questions, talk to uscustomer directory Porto Seguro, Itaú, Azul, among others, according to your contract.

*Published in:

Be careful when naming the main driver on your car insurance

Follow AFRILATEST on Google News and receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more!

Be careful when naming the main driver on your car insurance

SHARE POST AND EARN REWARDS:

Join our Audience reward campaign and make money reading articles, shares, likes and comment >> Join reward Program

FIRST TIME REACTIONS:

Be the first to leave us a comment, down the comment section. click allow to follow this topic and get firsthand daily updates on Insurance.

JOIN US ON OUR SOCIAL MEDIA: << FACEBOOK >> | << WHATSAPP >> | << TELEGRAM >> | << TWITTER >

Be careful when naming the main driver on your car insurance

#careful #naming #main #driver #car #insurance

-

Fashion3 months ago

Fashion3 months agoVogue Arabia cover welcomes Salma Hayek in an interview with Penélope Cruz

-

Football3 months ago

Football3 months agoVAR points out Diego Costa's offense against the fourth referee

-

USA today entertainment3 months ago

USA today entertainment3 months agoBeyonce with the single “Break My Soul” leads on Spotify Brazil

-

Health and Fitness3 months ago

Health and Fitness3 months agoVaccine against the reappearance of skin cancer enters final testing phase

-

USA today entertainment3 months ago

USA today entertainment3 months agoSZA, Future and DJ Khaled come together in collaboration

-

News3 months ago

News3 months agoParents of former player Waleswska are pressured by widower to pay rent for the house where they live

-

USA today entertainment3 months ago

USA today entertainment3 months agoLarissa Luz and Linn da Quebrada enchant at the Multishow Awards with a tribute to Elza Soares.

-

Good News TV series3 months ago

Good News TV series3 months agoThe shocking reason behind the decision not to show dead characters in The Last Of Us episode revealed