Car insurance simulation: see how to compare prices

Follow Us @

Car insurance simulation: see how to compare prices

-Receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more! Enjoy your stay!!

Follow this article and see how the car insurance simulation works and how to compare the prices received from different insurance companies!

The most reliable way to take out insurance with the best quality-price ratio is by comparing different car insurance quotes and their proposals.

Therefore, it is not only important to compare prices, but also to pay attention to the coverage and benefits that each service provider offers.

In car insurance, the secret is to find the best value for money and not the cheapest price.

Many people are aware of the importance of carrying out a car insurance simulation and comparing prices, but not everyone knows how to do this.

To better understand the process, read this article and understand how the car insurance simulation works and how to do it, in order to compare the prices received and make the best choice according to your vehicle usage profile.

How important is it to carry out a car insurance simulation?

Firstly, it is important to carry out the car insurance simulation to choose the appropriate insurance for your car and profile.

Although laborious, this process allows you to get to know the different insurance companies that operate in the market better and find out what coverage and services each one offers.

Furthermore, simulating car insurance is also important as this is a service that has a variable value.

This happens because prices are always calculated according to the risk of being involved in accidents that each user offers, through the risk analysis that is carried out and which involves several factors (length of time on the driver's license, previous involvement in accidents, among others). ).

In other words: as there is no standard amount to be charged for car insurance, carrying out the simulation becomes absolutely essential to choose the best solution for each case.

In other words, there is no standard amount to be charged for car insurance.

In a simulation, information as diverse as:

- Vehicle manufacturer and model;

- Model and manufacturing year;

- Name and date of birth of the interested party;

- CPF and driver's license number;

- Gender of the main driver.

Based on this information, the insurance company is able to formulate a primary proposal that acts as a starting point for the insurance itself – this is because, if you want extra coverage that is not detailed in the initial proposal, the final value of the car insurance increases.

If you wish to have access to more elaborate proposals, it is a good idea to consult an insurance broker, who is a professional trained to analyze and negotiate different options for you, presenting you with the one(s) that they consider most advantageous for your your usage profile.

With the car insurance simulations in hand, it will be easier to check what coverage each insurer offers and thus compare them all and see which are the most advantageous.

Is it possible to do a car insurance simulation online?

The answer is yes!

It is perfectly possible to carry out one or more car insurance simulations online, and you can therefore choose two different routes:

- individual simulation, which consists of accessing the website of each insurance company you are interested in and providing all the data requested in the quote so that the company can present a proposal;

- request specialized help through an insurance broker or even a website focused on car insurance simulations, such as SeguroAuto.org.

In the case of this last option, the advantage is not restricted only to the basic comparison of proposals from different insurers, but above all to the comparison of products belonging to the same service provider, which is why it is more complete and interesting for the majority of proponents.

It is important to mention that reduced deductibles usually have a higher premium value, and depending on the risks involved and amounts charged, it may be more advantageous to opt for them.

However, it is also very important that your driver profile and type of vehicle use are essential in determining the best option for you, as each profile corresponds to different proposals – there are cases, for example, in which the most interesting solution It involves choosing the increased deductible, which makes the premium value lower.

Here are some tips when simulating car insurance

Although it is a laborious process, simulating car insurance can be made easier if you follow some of these tips:

- Compare with as many insurance companies as possible;

- Get quotes with different and similar coverages to compare;

- Do not include incomplete or false information on the form;

- Choose renowned and credible insurers in the market;

- Choose only those coverages that are really important to you and exclude those that are ancillary;

- Don't just prioritize the lowest price, but consider the services offered as well;

- If possible, count on the services of a car insurance broker.

Why are there value differences in the car insurance simulation?

One of the most frequently asked questions concerns why insurance simulation values vary from one another.

This happens because there is a considerable range of factors to take into account when calculating the exact value of insurance, such as type, make and model of the vehicle, year of manufacture and also information about the use of the car, whether or not there is garage, and mainly information about the main driver, namely his accident history.

Each person who quotes their car insurance receives a different value and a different plan, and this happens because car insurance companies carry out an analysis of the driver and vehicle profile, including all this and other information.

Only after strictly analyzing each one of them will insurers inform which plans are available and their unit value.

Of course, whenever an insurance company calculates the value of your insurance, you can appeal, or request discounts, add or remove coverage – in other words, negotiate to have a more favorable price.

But be careful: there are types of insurance where you save even more!

So, if you want to have the exact value, do a car insurance simulation here on our website – just fill out a form and wait for a broker to contact you.

All of our professionals are registered with SUSEP and work in accordance with the necessary regulations.

Furthermore, they will provide information about plans and values only from renowned insurance companies that work within the rules imposed by SUSEP.

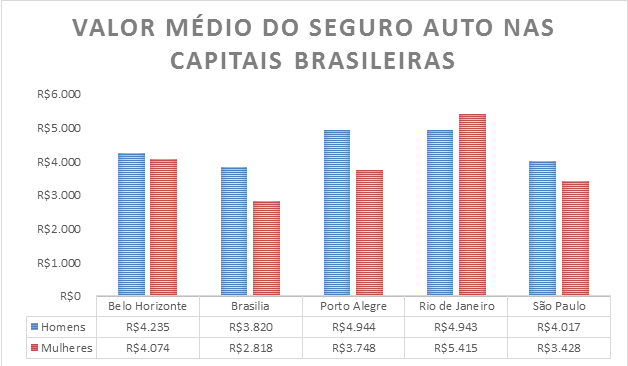

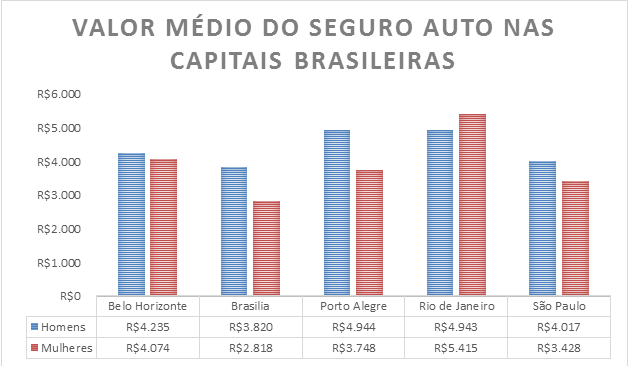

And how do car insurance price tables work?

It's possible that you've already seen one or more car insurance price tables out there and wondered whether they actually correspond to real values practiced in the market.

In fact, these tables work as a basis, so that interested parties have an idea of the value of car insurance taking into account only the car model and the most requested coverage.

In other words, car insurance tables do not inform the exact value, but rather the initial value according to the model of your vehicle and, in some cases, the year of manufacture.

Some car insurance tables can also inform the average value of car insurance according to the region and the period in which the insurance was taken out.

As is the case in the following table.

It considers the car insurance prices of the best-selling models in the month of May, in the main Brazilian capitals, according to the report from FENABRAVE – National Federation of Automotive Vehicle Distribution.

These values refer to models registered in May 2019, but if you want to know the current values and see other reports made available by the institution, simply access the FENABRAVE website and choose the 'indices and numbers' option.

Don't forget: research and negotiation are the keys to success in choosing the best car insurance – save on your wallet and headaches!

Car insurance simulation: see how to compare prices

Follow AFRILATEST on Google News and receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more!

Car insurance simulation: see how to compare prices

SHARE POST AND EARN REWARDS:

Join our Audience reward campaign and make money reading articles, shares, likes and comment >> Join reward Program

FIRST TIME REACTIONS:

Be the first to leave us a comment – Car insurance simulation: see how to compare prices

, down the comment section. click allow to follow this topic and get firsthand daily updates on Insurance.

JOIN US ON OUR SOCIAL MEDIA: << FACEBOOK >> | << WHATSAPP >> | << TELEGRAM >> | << TWITTER >

Car insurance simulation: see how to compare prices

#Car #insurance #simulation #compare #prices

-

Fashion3 months ago

Fashion3 months agoVogue Arabia cover welcomes Salma Hayek in an interview with Penélope Cruz

-

Football3 months ago

Football3 months agoVAR points out Diego Costa's offense against the fourth referee

-

USA today entertainment3 months ago

USA today entertainment3 months agoBeyonce with the single “Break My Soul” leads on Spotify Brazil

-

Health and Fitness3 months ago

Health and Fitness3 months agoVaccine against the reappearance of skin cancer enters final testing phase

-

USA today entertainment3 months ago

USA today entertainment3 months agoSZA, Future and DJ Khaled come together in collaboration

-

News3 months ago

News3 months agoParents of former player Waleswska are pressured by widower to pay rent for the house where they live

-

USA today entertainment3 months ago

USA today entertainment3 months agoLarissa Luz and Linn da Quebrada enchant at the Multishow Awards with a tribute to Elza Soares.

-

Good News TV series3 months ago

Good News TV series3 months agoThe shocking reason behind the decision not to show dead characters in The Last Of Us episode revealed