Follow Us @

Guide to buying car insurance and saving

-Receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more! Enjoy your stay!!

Anyone who owns a car knows that in order for it to be protected, it is not enough to just rely on luck, it is necessary to take measures to achieve this. And today the best way to protect yourself is to take out car insurance, but before taking out insurance you need to pay attention to some items.

So check out the tips we have put together so you can choose your car insurance with peace of mind and with the certainty that you got a good deal.

Choose a trustworthy insurance company

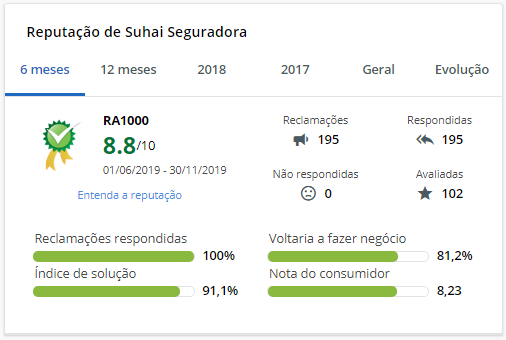

Before you go out and get a quote from a bunch of insurance companies, you need to check if they are trustworthy, because if an accident occurs, they will be the one who will bear part of the costs.

So if you already have good references for her, this will be a good step forward, but the problem occurs when you don't know the services she provides. In this case, you need to do some research, which can be done with people you know or on specialized forums on the internet. Additionally, you can do a search on the Susep website to check if it is accredited.

And for those who are always looking for more information, they can search the consumer complaints index, and this information can be obtained from Procon and on a website like Reclame aqui.

Choose a less popular car model

A fact that many people do not pay attention to when purchasing the vehicle is if it is very targeted by criminals, this is because some models suffer much more theft than others. It is logical that the more stolen this car is, the higher the insurance value will be.

Another important point that can make insurance more expensive or cheaper is the availability of spare parts. This is because traditional insurance can only use new parts in the case of replacement and when these are expensive or difficult to find, the value is passed on to the premium.

Furthermore, labor is taken into consideration, original factory cars that have never been modified are handled in most workshops, while modified ones require qualified labor that is difficult to find.

Pay attention to coverage

Insurance is not all the same and what will differentiate one product from another is the coverage offered. The most basic insurance is against theft, theft and fire and in this case it will not include any other services. It is not usually very advantageous, as it leaves the driver unprotected in several aspects and does not make a big difference in value to the total insurance.

Total insurance, in addition to this coverage, will also include collisions, thus allowing repairs to the vehicle. This is the most commercialized type because it has a greater scope. Furthermore, he may or may not have the third party insurance. This will include moral and material damages to third parties and this includes not only the vehicle but walls, being run over and others.

Don't add extra services you can't afford

One move by insurance companies to try to sell you extra services is to always present them as a great benefit, but you need to check whether they end up paying off. For example, insuring headlights is only worth it if they have a very high value and it is not worth paying extra in case of damage.

Other additional services such as home assistance, services for women and others need to be studied very well. This is because despite appearing to be a great benefit, they may end up not being used and will only make your insurance increase in value and this may mean that it does not fit into your budget. So before you decide, do the math.

Choose what the deductible will be in the event of an accident

A franchise It is not fixed, in fact, it corresponds to an amount that the insured must pay in the event of partial loss of the vehicle. This amount must be paid directly to the workshop that will repair the vehicle.

The common deductible is a value that the insurer itself establishes considering the value of the insurance and replacement parts. The increased deductible causes the insured's participation to be greater and as a consequence the value of the premium decreases.

The reduced deductible works in exactly the opposite way, that is, the amount paid in this case will be lower and in compensation the value of the premium will increase.

Simulate the price of your car insurance on our form.

Therefore, when choosing the franchise, you need to not only think about your pocket, but also consider the possibilities of the car suffering some type of damage.

Choose insurance for services and not just for value

A very common mistake that people make when choosing insurance is to only consider the value and not the services it offers. If you compare the value of anti-theft insurance with comprehensive insurance, it is logical that anti-theft insurance will be cheaper, but it will not have all the coverage.

In addition, there are assistance services such as towing services, assistance in cases of dry breakdowns and mechanical and electrical problems, discounts at partner establishments and others that need to be taken into consideration when carrying out this analysis.

That's why it's important to think about your pocket, but on the other hand, you need to consider what the benefits will be achieved for this amount.

In case of repairs, ask for guarantees

A big problem is not knowing if the part used in your car is really original, and according to legislation in Brazil, when the repair is carried out by the insurance company, they must be. Therefore, whenever you are going to carry out a repair, ask to find out the origin of the parts and a guarantee that they are original, this can be achieved through invoices.

This request must be reinforced even further when the workshop is recommended by the insurance company, although there cannot be this requirement, they can indicate some places or have their own automotive centers. This is the only way to guarantee that your car will continue to work well.

If you are entitled to a bonus, take advantage of it

Many people who have insurance do not know that they are entitled to the bonus and this is a benefit that all policyholders can achieve. This consists of a score that goes from 0 to 10 and the driver adds points according to the time he uses the car insurance service (regardless of the insurance company) and also according to the number of accidents and reasons for them.

This bonus can be used to get discounts on policies and the higher your score, the greater the savings. So if you've had insurance for some time, it's worth asking the broker about the bonus and the best part is that it continues to be valid and accrued even if you change insurance company.

Be a good driver

It is necessary to drive within the law, because drivers who suffer accidents under the influence of drugs and alcohol lose the right to insurance coverage, so it will be of no use in this case and you will still be left with a huge loss.

Those who participate in rechas are also not entitled to insurance coverage as it is an illegal activity. Therefore, anyone who always wants to be protected needs to respect traffic legislation.

Be honest on the form

In order for you to receive a quote that suits your profile, insurance companies request that you fill out a form to understand the driver's profile and also their habits with the vehicle. When filling out this form, you must not lie or omit any requested information, because in addition to influencing the final value of the prize, they will also serve as a basis when paying the compensation.

This form usually requests data from whoever drives the vehicle, both the main driver and others and in this case, if there are young people, insurance tends to be more expensive as they are statistically involved in more accidents.

Furthermore, it is questioned whether the vehicle has security equipment such as alarms and trackers that could cause the value to drop. The place where the car is usually parked will also have an influence, because if it is parked in private locations, the insurance company understands that it is more protected, unlike cases where it is parked on the street.

Groups and associations

There are companies and associations that offer their members the possibility of taking out insurance through them. In this case, insurance is carried out individually and each insured person will have their own policy, but with a great price advantage.

This happens because the insurance company will obtain a good number of customers and as a benefit ends up offering them discounts that can reach up to 40% when compared to individual policies. So it's worth researching whether you can get this benefit in some way.

Search and get quotes

Once you understand a little more about how insurance works, it becomes much easier when choosing the service, because you know exactly what is being contracted. So when making quotes, put in your preferences and the services you will really need so that you can compare prices.

At this time, it is worth doing the research with more than one insurance company, which can be done in person or online, with the online option always being faster, ideal for those who don't have much time. With the quotes in hand, it will be easy to see that there is a wide variation in prices from one insurance company to another, even when opting for similar services.

Therefore, only after having several quotes in hand should you choose which insurance company you will contract the service with.

Choose the form of payment

The most common payment method is to pay the premium in installments, however this can make the insurance a little more expensive. So that you can better understand, the value of the insurance will be calculated based on your profile and that of the driver and the result will be demonstrated in a single installment, which is usually around 10% of the value of the car.

Once the insurance value has been calculated, you will need to negotiate the payment method, but what is most common is to divide the value into installments so that they fit into the budget. However, when doing this, some fees may be added, so always try to negotiate according to your budget and in a number of installments that do not generate charges.

Ask

Even after receiving all the information from the broker, some doubts may arise or some information may not be very clear. It is very important that these issues are clarified, because they could result in an unpleasant surprise in the future.

Read the policy

Even after clarifying any doubts, it is important to read the policy carefully, as it will contain all of the insured's obligations and coverage in writing. It is important to check that everything agreed is included in the policy and that the vehicle and owner details are correct. If there is any irregularity, it must be corrected before signing the policy.

If applicable, ask to take it home so you can read it more calmly and only then should you sign it.

Guide to buying car insurance and saving

Follow AFRILATEST on Google News and receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more!

Guide to buying car insurance and saving

SHARE POST AND EARN REWARDS:

Join our Audience reward campaign and make money reading articles, shares, likes and comment >> Join reward Program

FIRST TIME REACTIONS:

Be the first to leave us a comment – Guide to buying car insurance and saving

, down the comment section. click allow to follow this topic and get firsthand daily updates on Insurance.

JOIN US ON OUR SOCIAL MEDIA: << FACEBOOK >> | << WHATSAPP >> | << TELEGRAM >> | << TWITTER >

Guide to buying car insurance and saving

#Guide #buying #car #insurance #saving

-

Fashion3 months ago

Fashion3 months agoVogue Arabia cover welcomes Salma Hayek in an interview with Penélope Cruz

-

Football3 months ago

Football3 months agoVAR points out Diego Costa's offense against the fourth referee

-

USA today entertainment3 months ago

USA today entertainment3 months agoBeyonce with the single “Break My Soul” leads on Spotify Brazil

-

Health and Fitness3 months ago

Health and Fitness3 months agoVaccine against the reappearance of skin cancer enters final testing phase

-

USA today entertainment3 months ago

USA today entertainment3 months agoSZA, Future and DJ Khaled come together in collaboration

-

News3 months ago

News3 months agoParents of former player Waleswska are pressured by widower to pay rent for the house where they live

-

USA today entertainment3 months ago

USA today entertainment3 months agoLarissa Luz and Linn da Quebrada enchant at the Multishow Awards with a tribute to Elza Soares.

-

Good News TV series3 months ago

Good News TV series3 months agoThe shocking reason behind the decision not to show dead characters in The Last Of Us episode revealed