When does it pay to take out additional car insurance coverage?

Follow Us @

When does it pay to take out additional car insurance coverage?

-Receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more! Enjoy your stay!!

Additional auto insurance coverage can offer extra protection for your vehicle, but it comes at a cost. Find out what they are and whether they are worth hiring.

When requesting a car insurance quote and receiving the proposal, if you analyze the information, some doubts may arise. Those who don't know the service very well may come across the additional coverages and not know what they are.

This happens because many people don't know about the possibility of taking out different coverages. Furthermore, so that you can personalize the service, some things are optional.

Learn about additional coverages and find out if they are worth opting for.

Image: Getty Images

What are additional coverages?

When taking out car insurance, insurers provide a basic coverage package. These can include robbery and theft or be a little more complete. The second case includes theft, theft, fire and collision with total or partial loss.

Additional toppings serve as a kind of optional. They are made available by insurance companies and the person decides which one they want to have or not.

They can be sold individually or as a package. It is worth mentioning that each time you include additional coverage in your insurance, the value increases.

It is important to differentiate between additional coverage for assistance services. Coverage aims to protect some part of the vehicle if it suffers damage.

The assistance helps the insured, for example, when they run out of gas, have a flat tire, etc., the towing or emergency service can be sent in these situations.

What are the additional car insurance coverages?

There are a number of additional coverages that can be included in car insurance. We have listed some so you can get to know them.

Civil Liability (RCV)

This is coverage that should be taken out by anyone who is concerned about damage they may cause to third parties and is not willing to bear the costs out of their own pocket.

It can include material, bodily and moral damages. For example, if you were driving and ended up hitting another car, you will have to pay for repairs for yours and the other.

With this protection, the insurer covers the costs to repair the other vehicle within the contracted value limit.

Accessories and additional items

Insurance basically protects the carcass of the vehicle, so this coverage protects the rest.

It can be used, for example, for the gas kit, multimedia equipment, sound, modified wheels, armor and others.

Depending on the insurer, you will have specific protection for each item, which means you can be compensated for it.

Brand new car coverage

We all know that when a car leaves the dealership it depreciates in value, but no one wants to lose money so soon.

In this case, the protection is valid for 180 days upon leaving the dealership. If something happens to the car that leads to a total loss, the value of the invoice and not the Fipe Table will be compensated.

Backup car

If the vehicle is stolen or left in the workshop for a long period of time, the backup car helps keep it from being driven on foot.

The insurance company lends you a car so you can drive while you don't have yours. The period that this vehicle is available varies depending on what is stipulated in the policy, usually ranging from 7 to 30 days.

Personal passenger accident

This coverage is widely used by those who work with cars transporting people. It guarantees compensation if the occupants suffer an accident in the car.

In this case, the compensation is used to cover medical and hospital expenses, death or disability.

When is it worth taking out additional coverage?

It is possible to see that there are several additional coverages, but it is not worth hiring them randomly. This is because adding them can greatly increase the price of insurance, and savings are usually sought.

This doesn't mean they should be dismissed outright. It's worth betting on some of them depending on your needs.

If you have car accessories in your vehicle, they need to be protected. If you work with vehicles and people, you need to guarantee compensation for them. If you can't do without your car, you need to have a spare.

Of all the additional coverage, perhaps the one most sought after is civil liability coverage. This is because anyone can have an accident and be the cause of it, no matter how cautious they are behind the wheel.

We can say that it pays to take out additional car insurance coverage depending on how you use the car and what it has. Before discarding the possibilities, make an assessment of what is a good cost-benefit and make the investment.

When does it pay to take out additional car insurance coverage?

Follow AFRILATEST on Google News and receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more!

When does it pay to take out additional car insurance coverage?

SHARE POST AND EARN REWARDS:

Join our Audience reward campaign and make money reading articles, shares, likes and comment >> Join reward Program

FIRST TIME REACTIONS:

Be the first to leave us a comment, down the comment section. click allow to follow this topic and get firsthand daily updates on Insurance.

JOIN US ON OUR SOCIAL MEDIA: << FACEBOOK >> | << WHATSAPP >> | << TELEGRAM >> | << TWITTER >

When does it pay to take out additional car insurance coverage?

#pay #additional #car #insurance #coverage

-

News3 months ago

Harry decides to appeal after loss of police protection in the UK

-

Good News TV series3 months ago

Preta Gil is the new presenter of TVZ on Multishow

-

Good News TV series3 months ago

Justin Bieber and Hailey go to church using a powerful car

-

Good News TV series3 months ago

Fuzuê: Pascoal is sentenced to more than 70 years in prison

-

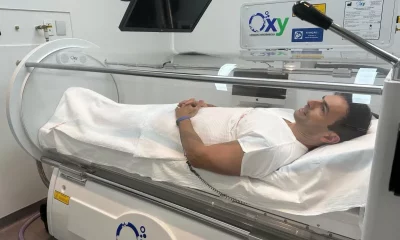

Health and Fitness3 months ago

Hyperbaric Oxygenation accelerates recovery from knee injuries, according to USP study

-

Trending Game3 months ago

Season 4 of Mortal Kombat 1 launches today with new trailer

-

Good News TV series2 months ago

The Childhood of Romeo and Juliet: Cast reunites in the final stretch

-

Afrilatest Reviews2 months ago

Analysis | Persona 3 Reload is a remake made with great care and quality