Understand everything about Personal Accident Insurance for Passengers

Follow Us @

Understand everything about Personal Accident Insurance for Passengers

-Receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more! Enjoy your stay!!

Personal Accident Insurance for Passengers is coverage for those who want to protect everyone in the car. Find out everything in the article!

To take out Personal Accident Insurance for Passengers, you must contact an insurance company and request coverage.

It can be a single coverage, insurance with just this function, or it can also appear as an additional addition to car insurance.

So, you can include this protection in your car insurance, to make everyone's transportation safer.

But there is also the option of taking out only Passenger Personal Accident insurance, if you do not wish to have other protections. For example, against theft or robbery.

As its name suggests, APP insurance protects the occupants of the insured vehicle. If an accident occurs, these people will receive compensation from the insurance company. Or, if applicable, your beneficiaries will receive it.

Compensation is paid in the event of death or disability. The service can be hired by any driver. Whether by those who use the car on a daily basis, or by taxi drivers and app drivers.

In fact, Personal Accident Insurance for Passengers is a requirement of companies like Uber. Only after hiring can the driver work with the application to transport people.

Continue reading and find out more about the coverage of this type of car insurance.

Image: Getty Images

Types of personal accident insurance coverage for passengers

As mentioned, APP insurance offers coverage for passengers of the insured vehicle who are involved in an accident.

Anyone in the car will be covered. Thus, they or their beneficiaries will receive compensation after the incident. Insurance protects everyone in different situations. See below.

Death

One of the APP insurance coverages is in the event of death. In other words, if one of the occupants of the vehicle dies after an accident, the insurance company will pay compensation.

Claims can be very diverse. From accidents to objects falling onto the car. It all depends on the coverage offered by the insurance company. To find out what situations are covered, it is important that you read the insurance policy.

In cases of death, then, the person who receives the compensation is the beneficiary of the deceased individual. It could be your spouse, children, parents or others.

The objective of compensation is to guarantee financial assistance to the family at this time of loss.

Permanent disability

Another situation in which Personal Accident Insurance for Passengers offers coverage is permanent disability.

That is, when the individual suffers permanent injuries or loss of a limb. In these cases, the compensation will aim to offer financial assistance to the individual, including for their new health needs.

The amount of compensation varies depending on the type of injury and what the insurance policy says about it. It is important to read the document carefully and also check the Susep table with the percentages paid for each injury that occurred.

Susep is the Private Insurance Superintendency, the body responsible for regulating the insurance sector.

For example: in the case of the loss of one of the fingers on the hand, the affected passenger must receive 10% of the total insurance amount.

Medical and hospital expenses

Finally, APP insurance covers medical expenses for passengers affected in a car accident. Therefore, the compensation paid by the insurance company aims to pay for hospital expenses after the accident.

The amount can pay, for example, for hospitalization and necessary surgeries.

How to take out passenger accident insurance?

When taking out APP insurance, you need to do your research well. Some insurers offer the insurance separately, while others only allow it to be purchased as an add-on to car insurance.

So, it's important that you know what you want. Will the protection be an extra on car insurance? Or will it be the only protection you will hire?

With this defined, it will be simpler to search for insurance companies and find the most suitable ones.

The next step will be to request a quote. This way, the company will be able to assess your risk of loss and define the insurance price.

Loss risk is nothing more than the risk that you and your car will suffer an accident. To define it, several aspects of the car and driver profile are evaluated.

For example: a younger driver tends to pay more for insurance. After all, insurers understand that these drivers have less experience behind the wheel. So, they are more prone to accidents.

But it is worth remembering that insurance companies charge different prices for insurance. This is because they give greater “weight” to one factor or another in the profile of the car and driver.

Therefore, it is important to compare the services of the companies, to take out more affordable Personal Accident Insurance for Passengers.

Understand everything about Personal Accident Insurance for Passengers

Follow AFRILATEST on Google News and receive alerts for the main trending insurance news today, car insurance updates, types of insurance, latest insurance opportunities and lots more!

Understand everything about Personal Accident Insurance for Passengers

SHARE POST AND EARN REWARDS:

Join our Audience reward campaign and make money reading articles, shares, likes and comment >> Join reward Program

FIRST TIME REACTIONS:

Be the first to leave us a comment, down the comment section. click allow to follow this topic and get firsthand daily updates on Insurance.

JOIN US ON OUR SOCIAL MEDIA: << FACEBOOK >> | << WHATSAPP >> | << TELEGRAM >> | << TWITTER >

Understand everything about Personal Accident Insurance for Passengers

#Understand #Personal #Accident #Insurance #Passengers

-

News3 months ago

Harry decides to appeal after loss of police protection in the UK

-

Good News TV series3 months ago

Preta Gil is the new presenter of TVZ on Multishow

-

Good News TV series3 months ago

Justin Bieber and Hailey go to church using a powerful car

-

Good News TV series3 months ago

Fuzuê: Pascoal is sentenced to more than 70 years in prison

-

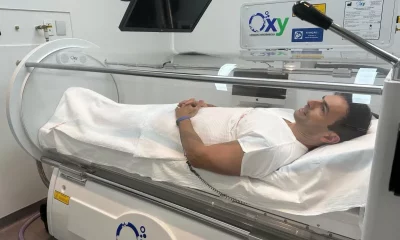

Health and Fitness3 months ago

Hyperbaric Oxygenation accelerates recovery from knee injuries, according to USP study

-

Trending Game3 months ago

Season 4 of Mortal Kombat 1 launches today with new trailer

-

Good News TV series3 months ago

The Childhood of Romeo and Juliet: Cast reunites in the final stretch

-

Afrilatest Reviews3 months ago

Analysis | Persona 3 Reload is a remake made with great care and quality